Permanent Virtual Account

A payment method type, generally used in Indonesia to eliminate the need for manual payment confirmation. In Martis, there are two types of virtual accounts used in the Core API service; a virtual account charges and an permanent virtual account

As explained in the Charges section for virtual account charges, the difference being is that a permanent virtual account itself would remain available for payment even though it was once paid or failed. Martis's permanent virtual account has two characteristics:

- Open — Permanent virtual accounts would always be an open type virtual account.

- Permanent — Persists indefinitely, simply the virtual account number is not automatically removed or expire — continues to exist until explicit action removes it.

If a permanent virtual account has been paid, it would be updated on your Payment Charge table and recorded as a Transaction tab on your Balances page.

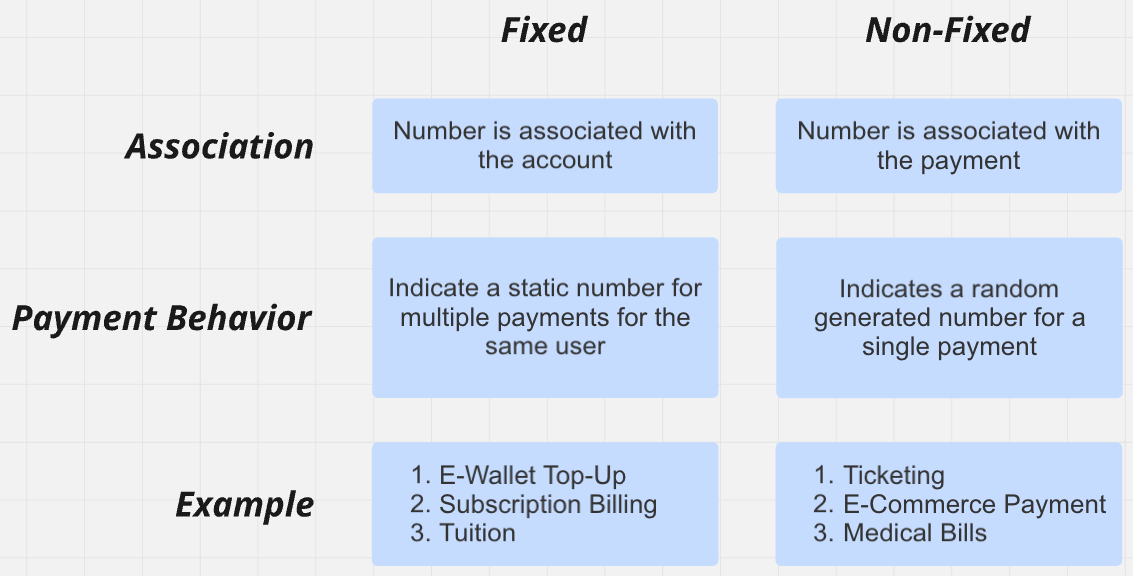

In general, between virtual account charges and permanent virtual accounts, there are three categories that could be distinguished between the two:

- Allocation Number

- Nominal Payment

- Usage Type

To setup a permanent virtual accounts for your business, contact our assigned team to get started.

Allocation Number

Based on the allocation number, there are two types of virtual accounts:

- Fixed virtual account

- Non-fixed virtual account

A fixed and non-fixed virtual account is distinguished from the association and the payment behavior.

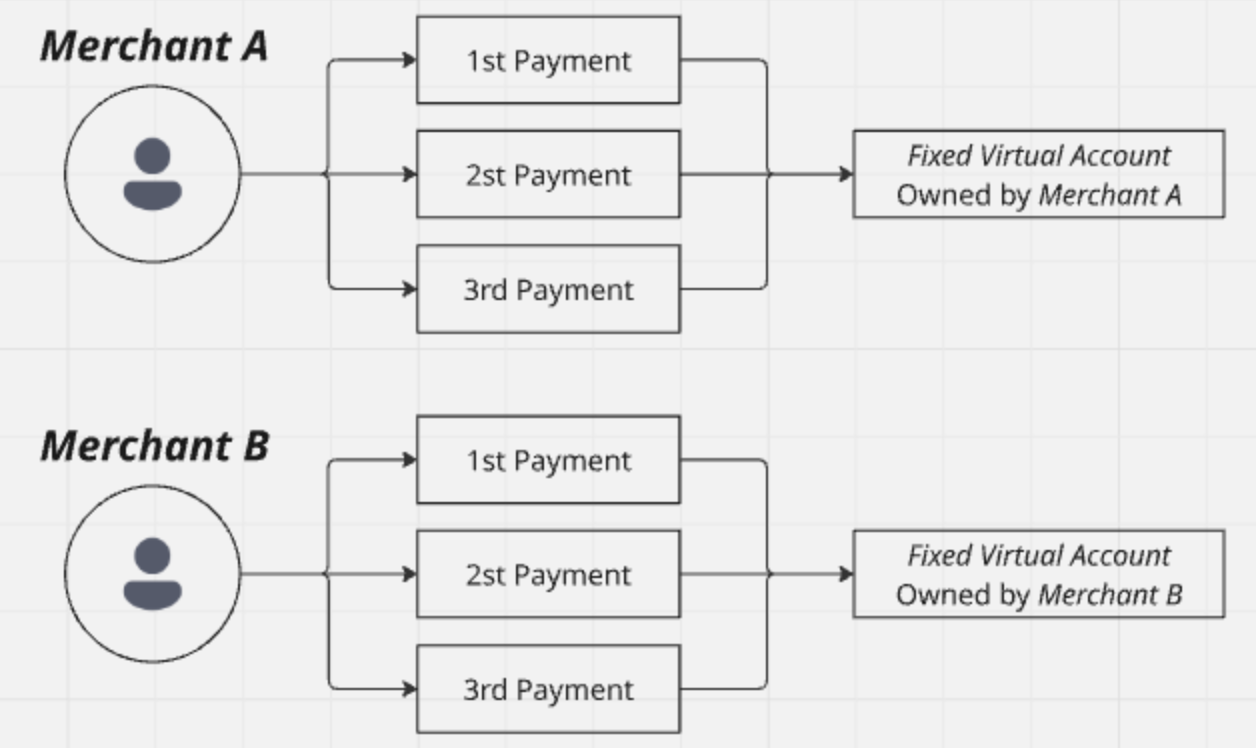

Fixed Virtual Account

In a fixed virtual account, a unique account number is assigned to each account. Eventually multiple payments are bound to that virtual account for all their transactions. Like any other types of virtual accounts, a virtual account could be given a name to identify a payment. In this scenario, a fixed virtual account is available for both virtual account charges and permanent virtual accounts.

An example of a fixed virtual account is a top-up service on e-wallets like GoPay or OVO. If a business model ensures users to make payment for products and services multiple times, then a fixed virtual account would be the best choice.

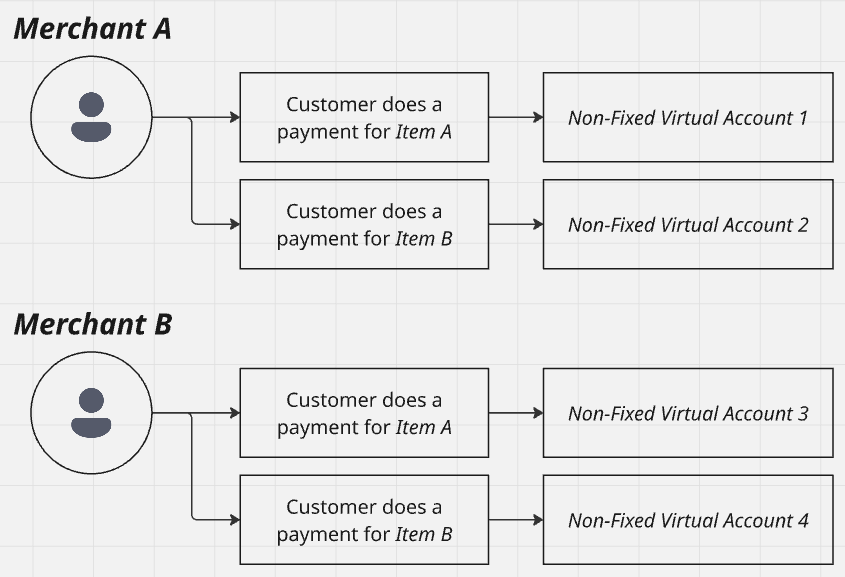

Non-Fixed Virtual Account

In a non-fixed virtual account, a unique account number is assigned to each payment. This type of virtual account is usually used for a one-time payment for a product or a specific service. For a non-fixed virtual account generation, digits will be randomly generated for each payment.

An example of a non-fixed virtual account is an e-commerce platform. Customers are given a one-time payment number for each transaction or services that they order.

Notice that for each order, none of them are correlated to each other. So a non-fixed virtual account is tied only to a specific payment and thus used only for a single payment.

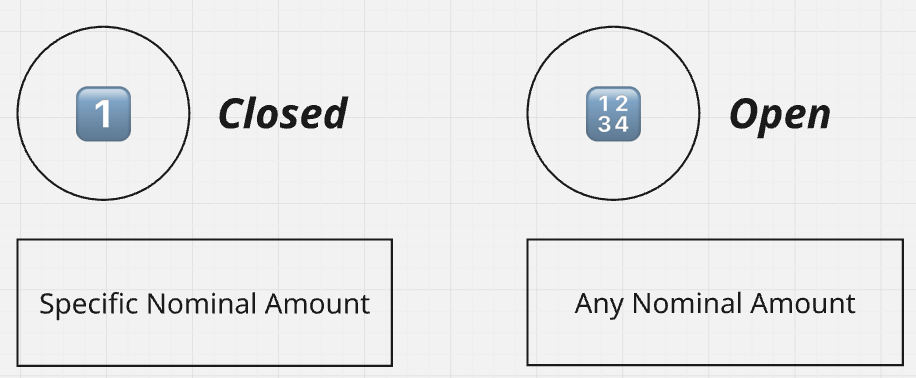

Nominal Payment

Based on how virtual accounts are paid, this category would discuss the differences between:

- Open Virtual Accounts

- Closed Virtual Accounts

Open Virtual Accounts

Open types accept payments in any nominal amount. This type is used mainly on top-up services in e-wallets, customers are able to pay in any given amount.

Closed Virtual Accounts

Closed types could only be paid with a pre-defined nominal when creating a payment. If a merchant creates an closed virtual account and sets it nominal to Rp. 100,000, any payment besides that nominal would count as a failed payment. Usually, closed virtual accounts are used to avoid wrong payments.

Usage types

On the last category, based on the usage of virtual accounts, there are two types:

- Single Use

- Multiple Use

Single Payment

When Single types are paid once, the virtual account generated here will expire and no longer available to be paid again.

Multiple Payments

Multiple types, on the other hand, can be used for multiple payments as long as it's status is still active. As per mentioned earlier, this is specially perfect for use-cases of recurring payments such as installments, subscriptions, utility bills, etc.