Payouts

Payouts moves funds from an Martis balance to registered bank accounts or to recipients. Movement of funds to a registered bank accounts is considered as a withdrawal, and any movement of funds to a recipient outside of Martis is considered as a disbursement.

| Operation | Description | Initiated Via |

|---|---|---|

| Withdrawal | Transfer available balance to a registered bank account | Dashboard |

| Disbursement | Programmatic payment to any valid bank account | API |

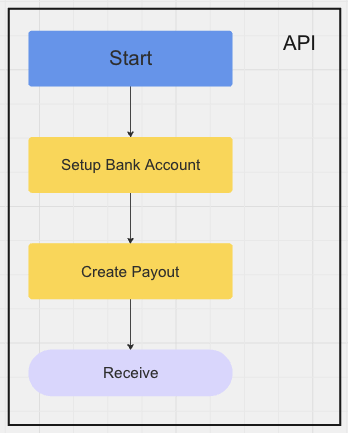

Payout Flow

The following diagram illustrates the payout process:

Lifecycle

A payout progresses through the following states:

- Name

pending- Description

Payout created, awaiting processing

- Name

processing- Description

Payout submitted to the banking system

- Name

completed- Description

Funds successfully delivered to the destination account

- Name

failed- Description

Payout failed due to validation or processing errors

- Name

cancelled- Description

Payout cancelled before processing

- Name

suspected- Description

Payout flagged for security or compliance review

- Name

rejected- Description

Payout rejected after review

- Name

refunded- Description

Funds returned to the source account