Account

Primarily represents a business on the Martis platform. Business information and documents are required and stored for verification and eligibility of usage throughout the operations done by the business in this platform.

Within the platform, other merchants are able to associate you within their accounts through member invitations. Once an invitation is accepted, you are able to switch into multiple accounts that are associated to you. Merchants are able to create a new business account when separation is required according to your needs.

Features

In a bigger picture, here's a general idea of what you could do with Accounts in Martis:

- Monitor recent transactions, payments and current available balances on the Dashboard Menu

- Execute payout services on registered or designated bank accounts.

- Manage and switch-in to multiple accounts that are associated with you

- Manage teams and roles for each accounts

- Create account integrations for Core API usages and handle events

- Collect financial reports for your business operations

Verification

A process to ensure compliance with financial regulations and prevents fraudulent activity. To verify your account, contact our assigned team to help begin the process. This process must be applied for every account creation.

Account verification process is completed in two stages:

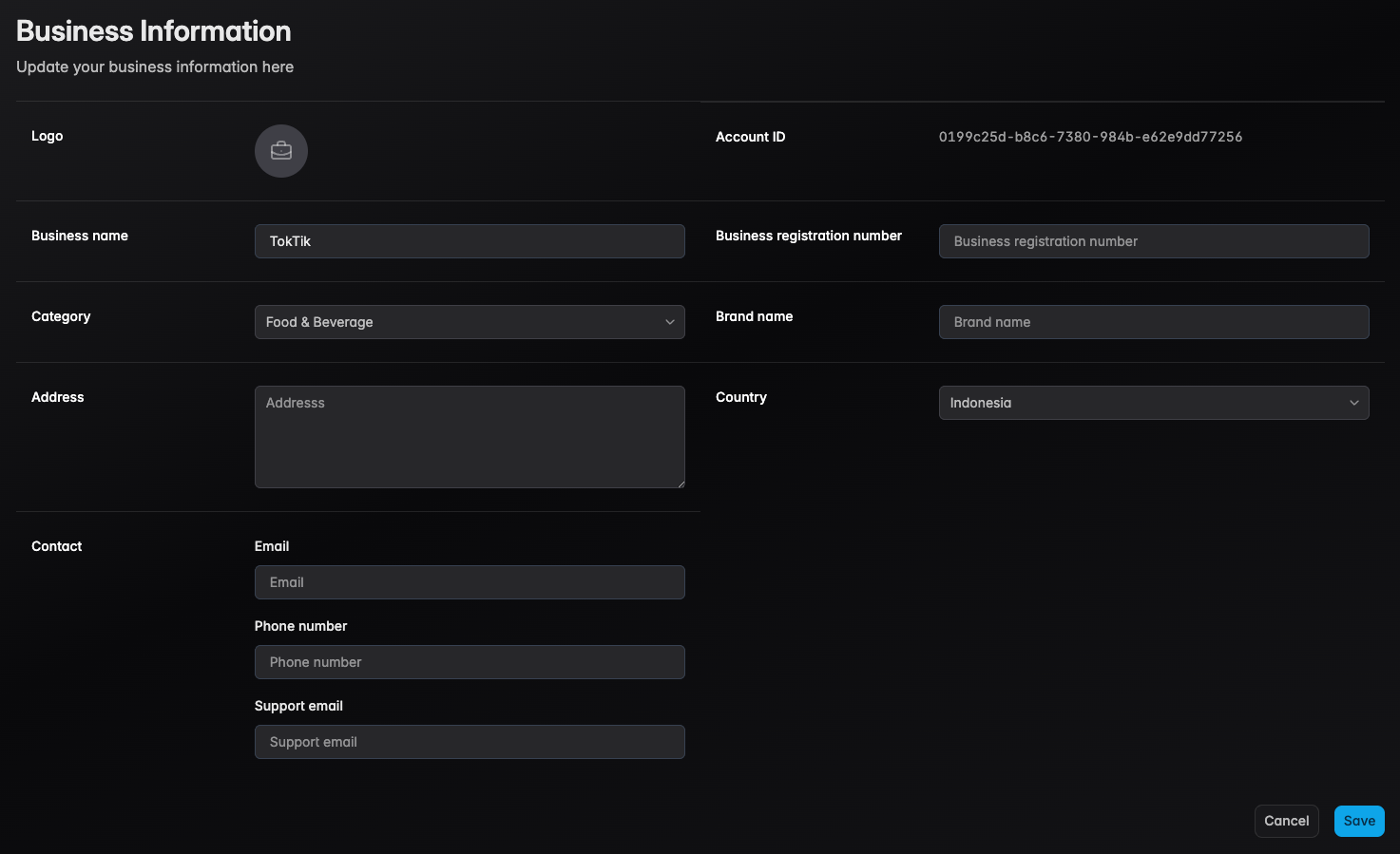

Stage 1 — Business Information

The following business information is required during onboarding:

- Name

Business Name- Description

Legal name of the business entity

- Name

Business Registration Number- Description

Official registration number issued by authorities

- Name

Category- Description

Industry or field of operation

- Name

Brand Name- Description

Operating name of the business

- Name

Address- Description

Registered business address

- Name

Country- Description

Country of registration

- Name

Contact Information- Description

Support email, person-in-charge, or owner contact details

Stage 2 — Document Verification

Documents are uploaded and will be verified by our assigned team. Here are the current list of required business document for the account verification process:

| Document | Description |

|---|---|

| National ID (KTP) | Government-issued identification |

| Company Tax ID (NPWP) | Tax registration number |

| Business Identification Number (NIB) | Official business registration |

| Bank Account Proof | Statement or document verifying account ownership |

If you experience any trouble with the Core API services usage, or endpoint behaviors are still not working despite having an activated account, please contact our assigned team and ask for further assistance or contact us directly.